Forex Education Center And Investment- Harga Emas Hari Ini,Emas memang komodity yang sangat menarik untuk selalu kita bicarakan setiap harinya.Emas juga merupakan jenis investasi yang memiliki tingkat return of investment tinggi dan juga memiliki tingkat liquiditas yang tinggi pula,oleh karena itu tidak heran rasanya bila masyarakat banyak yang menggunakan emas sebagai media investasi baik untuk jangka panjang atapun jangka pendek.

Sepanjang sejarah harga emas selalu mengalami kenaikan dari tahun ke tahun dan ini juga menjadi faktor pemicu bagi masyarakat untuk menjadikan komodity yang satu ini sebagai investasi save heaven.

Meskipun begitu dalam perjalanan harganya terutama dalam perdagangan emas berjangka tidak jarang harga emas juga sangat fluktuatif sehingga fase dimana harga naik atau turun juga mewarnai perjalanan logam mulia ini.

Sebagai bahan analisa untuk kita terutama untuk kita ynag sedang berdagang emas berjangka dibawah ini akan kami sajikan hasil Analisa teknikal harga Emas Hari ini,yang dapat kita gunakan sebagai acuan kapan kita harus membuat keputusan untuk melakukan aksi jual atau beli,sehingga kita bisa meraih keuntungan dengan segera dan semakin menjauhkan kepada kerugian perdagangan.

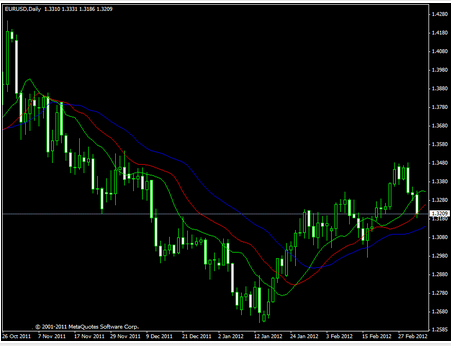

Untuk jelasnya silahkan perhatikan gambar dibawah ini

Melihat gambar diatas nampak dengan jelas bahwa harga emas hari ini akan mengalami kenaikan yang cukup signifikan,karena emas akan menuju titik resistance sebelum dia akan menuju harga jual yang kuat.

Dalam gambar diatas sudah kami sertakan dimana anda akan menjual dan dimana anda akan melakukan aksi beli untuk commodity ini ( XAU/USD) semua sudah tergambar dengan adanya tanda panah merah serta pola gelombang harga yang berwarna merah diatas.

Demikianlah Analisa harga emas hari ini semoga memberikan manfaat untuk anda,tidak ada salahnya bila anda berbagi tulisan ini untuk yang lain