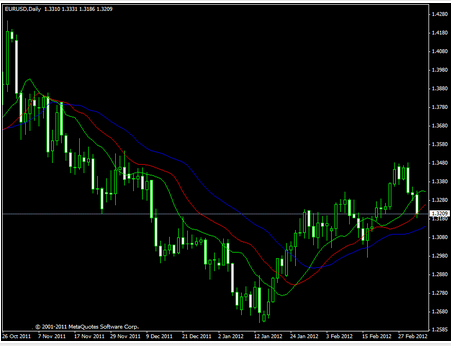

Forex Education center- technical analysis,technical Analysis or better known as technical analysis is an analytical technique known in the financial world that is used to predict the trend of a stock price by studying past market data, primarily price and volume movements, At first technical analysis only takes into account price movements market or instrument in question, assuming that the price reflects all relevant factors before an investor aware of through various other means. Technical analysis can use different models and base, for example, to use the method of price movements such as the Relative Strength Index, Index moving averages, regressions, inter-market correlations and intra-market, cycle or the classic way is to analyze the pattern of the graph.

Technical analysis is widely known among traders of shares (or known as "traders") and professionals in finance, but in the academic world is regarded as a pseudoscience or "voodoo finance;" it receives little or no direct support from academic sources and is Considered akin to "astrology."

Academics such as Eugene Fama say that the proof of this technical analysis is very thin and inconsistent which is "shortages" of the technique is generally accepted that the efficient market hypothesis The Economist named Burton Malkiel argues that "technical analysis is something that is forbidden (anathema) in the academic world "and then he says also that" in the form efficient market hypothesis is weak then engka will not be able to predict future stock prices based on past prices "."

In the foreign exchange market, technical analysis is more widely used by practitioners than the use of fundamental analysis. Several internal studies indicate that technical trading rules can generate consistent returns in the period up to 1987, most of the academic research focuses on the nature of the anomalous position of the currency market There is speculation that this anomaly occurs as a result of central bank intervention.